Last Mile Delivery Cost Calculator

Estimated Cost:

Ever wonder why your $15 online order costs $8 to deliver? Or why that same package costs $2 to ship across the country but $12 to get from the local warehouse to your front door? The last mile of delivery - the final stretch from a distribution center to your home - is the most expensive part of the entire supply chain. And it’s not getting cheaper.

What Exactly Is Last Mile Delivery?

Last mile delivery refers to the final leg of a package’s journey: moving it from a regional hub, urban fulfillment center, or local depot directly to the customer’s doorstep. It’s the part where a driver pulls up to your house, knocks on the door, and hands you that Amazon box. Sounds simple, right? But behind that quick handoff is a complex, inefficient, and costly operation.

Think of it like this: shipping a pallet of 500 items from China to a UK warehouse costs about £0.50 per item. But getting one of those items from the warehouse to your apartment? That can cost £3 to £8 - sometimes more. The last mile isn’t just expensive - it’s disproportionately expensive compared to everything that came before it.

Why Is It So Costly? The Big Five Reasons

There’s no single reason last mile delivery is so pricey. It’s a mix of logistics, geography, and consumer behavior all working against efficiency.

1. Low Density, High Effort

Most deliveries happen in residential neighborhoods where homes are spread out. A delivery van might drive 20 miles to drop off 12 packages. That’s 12 stops, 12 door knocks, 12 signature requests - and most of the time, the driver isn’t delivering to another house for another 15 minutes.

Compare that to a warehouse in Birmingham that ships 500 boxes an hour to other warehouses. That’s high-volume, predictable, and efficient. Last mile is the opposite: low-volume, unpredictable, and full of dead time.

In the UK, 62% of last mile deliveries go to single-family homes or flats with no concierge or lobby. That means no centralized drop-off point. Every stop is a separate task.

2. The Return Problem

One in every three online orders gets returned. And returns cost 2-5 times more than original deliveries. Why? Because returns aren’t grouped. They’re scattered. One customer returns a shirt. Another returns a toaster. The driver has to pick them up individually - often at inconvenient times - and bring them back to a hub that’s already full.

And here’s the kicker: most returns don’t even make it back to the original warehouse. They get processed at local return centers, adding another layer of handling, sorting, and transportation. That’s two last mile trips for one product.

3. Time Windows and Failed Deliveries

Customers want delivery between 8 a.m. and 8 p.m. - and often insist on a two-hour window. That means drivers can’t plan routes efficiently. They have to wait. They have to circle blocks. They have to make multiple attempts.

In 2024, UK delivery companies reported an average failed delivery rate of 14%. That means for every 100 packages, 14 had to be delivered again. Each failed attempt adds £2-£4 in labor, fuel, and vehicle wear. Multiply that by millions of deliveries, and you’re talking billions in wasted costs.

4. The Rise of Same-Day and One-Hour Delivery

Amazon, Deliveroo, and Ocado have trained customers to expect delivery in hours, not days. That means companies can’t batch shipments. They can’t wait for 50 orders to fill a van. They have to send out small, underutilized vans just for one or two packages.

One-hour delivery in London can cost £15-£25 per order. That’s not profit - that’s survival. Companies lose money on these services just to stay competitive. And the cost gets baked into every other delivery.

5. Fuel, Labor, and Regulatory Costs

Drivers don’t work for free. In the UK, the average delivery driver earns £12-£15 per hour - and that’s before national insurance, vehicle maintenance, and insurance. Many are self-employed contractors, meaning companies pay extra to cover benefits they don’t provide.

Fuel prices have stayed high since 2022. Electric vans are cheaper to run long-term, but they cost £40,000-£60,000 each. Most delivery firms can’t afford to replace their entire fleet overnight.

And then there’s London’s Ultra Low Emission Zone (ULEZ). If your van doesn’t meet Euro 6 standards, you pay £12.50 per day just to enter the city. That’s £62.50 a week per vehicle - and that’s just for one zone. Many companies now have to maintain separate fleets for different cities.

Who Pays the Price?

Logistics companies don’t eat these costs. They pass them on. Sometimes directly - through delivery fees. Sometimes indirectly - by raising product prices or cutting margins.

Small online retailers? They absorb it. That’s why you see small businesses charging £4.99 for shipping even when the product costs £9.99. They’re not making money on delivery. They’re just trying to stay alive.

Big players like Amazon and Asda use last mile losses as a loss leader. They know if you pay £10 for delivery once, you’re more likely to buy again. But they’re still losing money on each delivery - and they’re betting you’ll buy enough to make up for it.

What’s Being Done to Fix It?

Some companies are trying to fix the problem - not by cutting corners, but by rethinking how packages move.

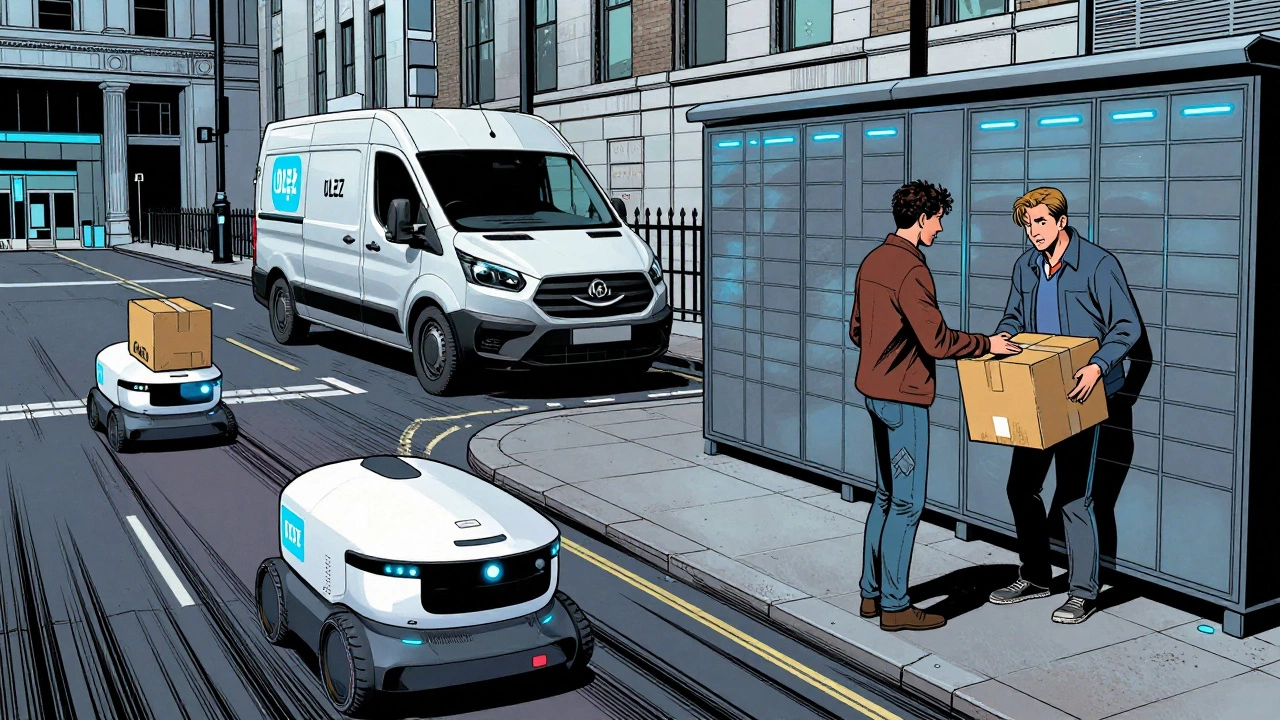

- Lockers and pickup points: Amazon Locker, Collect+ and DPD Pickup Points cut failed deliveries by 40%. Customers pick up their own packages, saving drivers time and fuel.

- Micro-fulfillment centers: Companies like Ocado are building tiny warehouses inside cities. A package goes from warehouse to doorstep in under 2 hours - but the distance is only 2 miles, not 20.

- Group delivery: Apps like Roadie and Uber Connect let shoppers and drivers combine deliveries. One van drops off groceries for five people on the same street.

- Autonomous delivery robots: Starship Technologies and Amazon Scout are testing robots on sidewalks in Manchester and London. They cost £0.50 per delivery - but they’re slow and can’t handle rain or stairs.

None of these solutions are perfect. But they’re all signs that the industry knows something has to change.

What Can You Do?

If you’re a customer, you can help reduce last mile costs:

- Choose a 24-hour delivery window instead of a 2-hour one.

- Use a pickup point or locker when you can.

- Bundle orders. Waiting two extra days to get five items together saves more than you think.

- Don’t return things unless you really need to.

These small choices add up. If every UK household skipped just one failed delivery a year, it would save £200 million in delivery costs.

It’s Not Going Away - But It Might Get Better

Last mile delivery will stay expensive for years. It’s the nature of the beast: delivering small things to scattered places is inherently inefficient. But innovation is happening. New tech, smarter routing, and shifting customer habits are slowly chipping away at the cost.

For now, the truth is simple: your cheap online deal isn’t cheap because of the product. It’s cheap because someone else is paying for the delivery.

Why is last mile delivery more expensive than long-haul shipping?

Last mile delivery costs more because it involves many small, scattered stops with low package density. Long-haul shipping moves hundreds of packages at once on trains or large trucks, spreading the cost across dozens of deliveries. Last mile delivers one or two packages per stop, often requiring multiple trips, failed attempts, and high labor time per package.

Do delivery companies lose money on last mile?

Yes, many do - especially for same-day or free-shipping offers. Companies like Amazon and Deliveroo operate at a loss on last mile to retain customers. They expect higher lifetime value from those customers. Smaller firms often charge more to cover costs, but still struggle to turn a profit on individual deliveries.

How much does last mile delivery cost in the UK?

On average, last mile delivery in the UK costs between £3 and £8 per package. For same-day or one-hour delivery, prices can reach £15-£25. Returns cost £6-£12 each. Urban areas with low-density housing and high traffic are the most expensive.

Are electric vans making last mile cheaper?

Electric vans reduce fuel and maintenance costs by 30-50% over time, but they’re expensive to buy - £40,000 to £60,000 each. Most delivery firms can’t replace their entire fleet quickly. So while they help long-term, they haven’t lowered prices yet. The savings will show up in rates once the fleet turns over.

Can I reduce my delivery costs as a customer?

Absolutely. Choose a longer delivery window, use a pickup locker, avoid returns unless necessary, and bundle orders. These small choices reduce failed deliveries and optimize routes. If millions of people did this, delivery costs would drop across the board.

If you’re a small business owner, focus on offering one reliable delivery option - not five flashy ones. Customers will pay more for reliability than for speed they don’t need.

Last mile delivery isn’t broken. It’s just the natural result of how we shop today. But change is coming - and the next time your package arrives, remember: someone’s driving a van for hours just to hand you a single box. And that’s why it costs so much.